Stablecoin follow-up plus OCC guidance, central banks and anonymous CBDCs, EU’s bankrupt foreign policy exposed

It doesn’t feel like a whole lot happened in the world of money and power last week, which is handy because I have some follow up thoughts about stablecoins from last week. I promise I’ll try no to turn this into stablecoins weekly, but ultimately I’m gong to write about what’s on my mind and what I’m trying to figure out for myself. As always, I very much welcome your feedback. Here’s what we got going on in this issue:

- Stablecoin-backed stablecoins and the OCC’s recent guidance

- Why do central banks think they can’t build anonymous CBDCs?

- Cyprus takes EU hostage, exposes its foreign policy bankruptcy

- Dollar death watch + various and sundry

Here we go.

Stablecoin-backed stablecoins are more of a thing than I thought

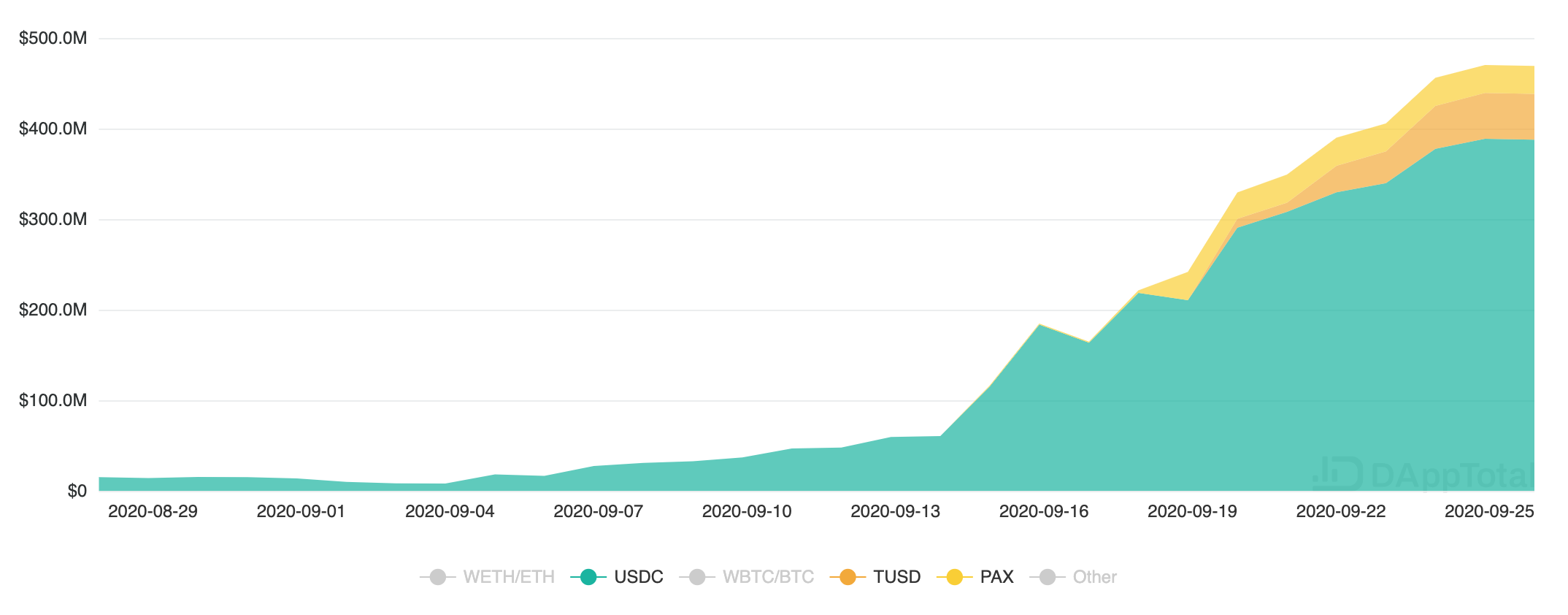

A little follow up from last week’s disquisition on stablecoins. First, I gave short shrift to crypto-collateralized stablecoins like Dai, but maybe I shouldn’t have. As I noted, I tend to discount these because I think maintaining the dollar peg is too challenging, and indeed in March Dai went way off its peg after “Black Thursday.” What I totally missed until it was pointed out to me last week is that MakerDAO addressed the issue by introducing USDC and other centralized stablecoins as collateral options. Since then its backing has increasingly been composed of centralized stablecoins like USDC, TUSD, and Paxos Standard, thus slowly coming to approximate in a roundabout way the decentralized stablecoin-backed stablecoin concept I find interesting. As of this weekend, about a third of MakerDAO’s collateral was composed of backed stablecoins, and the vast majority of that is USDC.

Centralized stablecoin collateral on MakerDAO over last 30 days. Source: DAppTotal

Centralized stablecoin collateral on MakerDAO over last 30 days. Source: DAppTotal

In theory, the more that regulated, audited, centralized stablecoins make up the collateral, the easier it will be to keep the dollar peg. And Dai is permissionless in the sense that it’s an ERC20 token that can be traded P2P without the possibility of prior restraint by the issuer. Unlike centralized stablecoins issued by a company, Dai are issued by a smart contract that cannot freeze funds. So, where before users had access to fiat-backed stablecoins that could be frozen by the company issuer, they now also have access to stablecoins that can’t be frozen by the smart contract issuer yet still benefit from the stability afforded by bank-held dollars.

As I hinted in my last missive, the pitfall that remains is that while a company issuer may not be able to block Dai transactions that its stablecoin backs, in theory it can freeze all of the funds in the DAO. In the case of Maker, that would involve blacklisting the USDC Adapter smart contract. It’s quite the nuclear option. For USDC, that would be about $385 million, or about 15% of its market cap. Presumably they wouldn’t do this without being compelled by the government.

Some folks on the Maker forums are sanguine about this, thinking it unlikely that the government would take such a drastic step: “[I]f a criminal was identified who had deposited USDC into a CDP, the USDC custodians could easily just freeze the depositing account rather than the whole adapter. This would freeze the criminal funds without affecting innocent people.” What this misses, though, is regulatory risk, which brings me to the next piece of follow up.

OCC guidance letter on stablecoins

Last week, the Office of the Comptroller of the Currency (OCC), the bureau of the Treasury Department that charters and regulates national banks, issued guidance saying that banks can hold reserve funds for stablecoin issuers. This was generally hailed as bullish news, and it is, but the guidance also raises a few questions. In particular, the letter is weirdly limited. It only blesses banks to hold dollar reserves for a “stablecoin in situations where there is a hosted wallet.” It goes on to state, “We are not presently addressing the authority to support stablecoin transactions involving un-hosted wallets.”

It’s not clear what that means. Does it mean that the letter only blesses holding reserves up to the amount held in hosted wallets? How would that work? Indeed, the letter’s very definition of whether a token is a stablecoin turns in relation to whether tokens are kept with a third party:

For purposes of this letter, we consider a “stablecoin” to be a unit of cryptocurrency associated with hosted wallets that is backed by a single fiat currency and redeemable by the holder of the stablecoin on a 1:1 basis for the underlying fiat currency upon submission of a redemption request to the issuer. We are only opining on those facts and circumstances at this time. (Emphasis added.)

What does it mean to be “associated with hosted wallets”? Is it enough if one percent of a stablecoin’s market cap is in hosted wallets while the other 99 are unhosted? Is it then “associated” with hosted wallets? Or does this mean that, as far as the letter is concerned, stablecoins are only those tokens in a hosted wallet?

Some folks have said this isn’t concerning since, after all, the OCC regulates banks, not P2P transactions, and that the letter’s caveat just means the OCC is saying it has no authority over unhosted wallets. That makes little sense to me. Agencies don’t typically list things they don’t have authority over unless there’s a good reason to do so. Also, the OCC doesn’t need to have any authority over wallets (hosted or unhosted) for their guidance to affect stablecoins because who they definitely have authority over is banks, and banks will take their cue from the OCC about what stablecoins they can and cannot bank—even if that turns on whether a stablecoin is “associated with” hosted or unhosted wallets.

To be clear, the letter in now way prohibits banks from servicing stablecoins that “are associated” with unhosted wallets. It’s explicit on this point: “We are not presently addressing the authority to support stablecoin transactions involving un-hosted wallets.” But put yourself in the shoes of a bank. Presumably the regs were already clear enough that the likes of U.S. Bancorp feel comfortable holding USDC’s reserves. Now, however, the OCC is saying by implication that it looks at “stablecoin transactions involving un-hosted wallets” as somehow different. That’s seems like uncertainty that there wasn’t before, and if there’s one thing banks don’t like it’s risk.

And you can see why banks might interpret Treasury’s hesitation about unhosted wallets as risk. What centralized stablecoins are essentially doing is taking tightly permissioned dollars (i.e. bank deposits) and turning them into pseudonymous permissionless dollars that can be sent from unhosted wallet to unhosted wallet without the friction of things like KYC. Which is great—its kinda the point—it makes them fast and programmable and capable of serving the unbanked, etc. But from an AML/CTF and sanctions perspective, they erode the kind of tools that this newsletter is all about.

Though I don’t think any change is imminent, this is why FATF has said banning unhosted wallets is an option regulators can consider “particularly if there is mass-adoption of a virtual asset that enables anonymous peer-to-peer transactions”:

There are a range of tools that are available at a national level to mitigate, to some extent, the risks posed by anonymous peer-to-peer transactions if national authorities consider the ML/TF risk to be unacceptably high. This includes banning or denying licensing of platforms if they allow unhosted wallet transfers, introducing transactional or volume limits on peer-to-peer transactions or mandating that transactions occur with the use of a VASP or financial institutions.

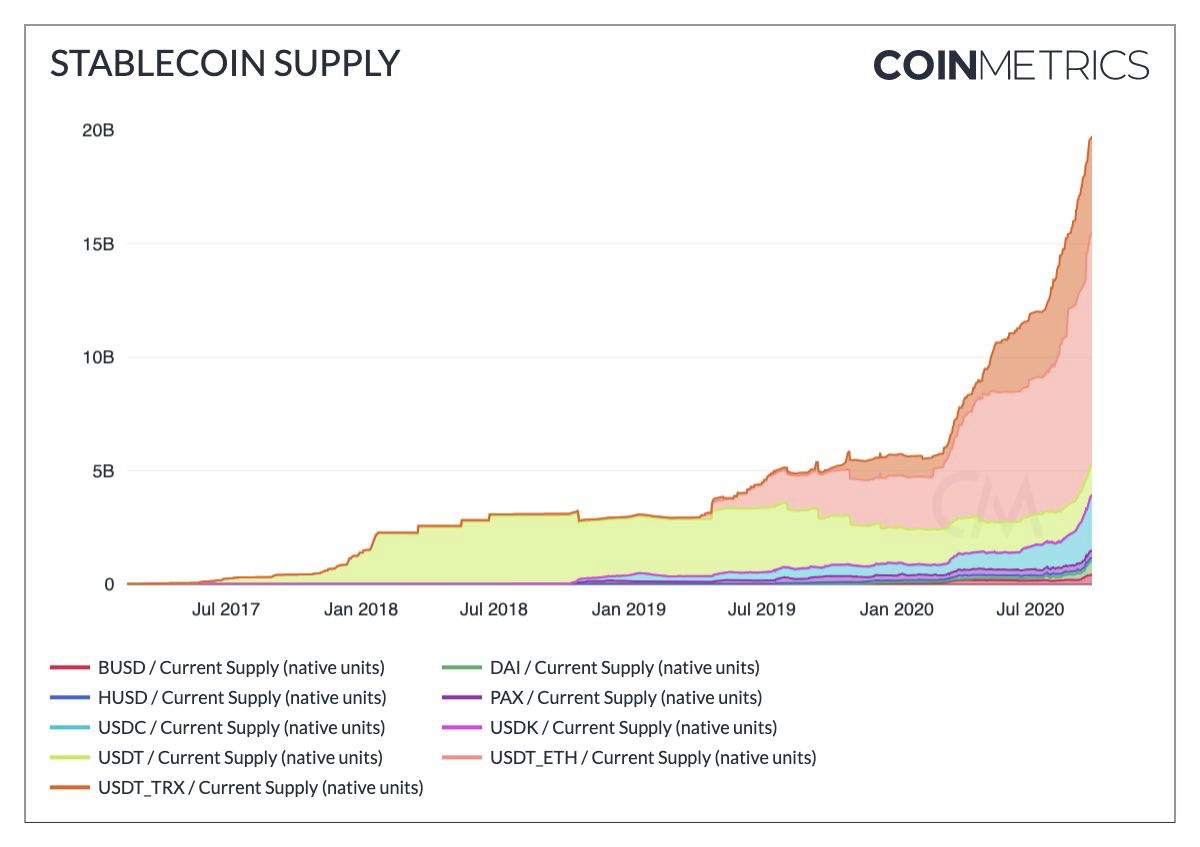

Unhosted wallet use at scale is partly the reason government freaked out about Libra, and why Libra’s new design holds off on incorporating unhosted wallets until some unspecified future date. While I don’t see “mass adoption” on the horizon anytime soon, the growth of stablecoins over the past few months has been remarkable.

That all leads me to a few conclusions:

- Given the boom in stablecoins and the competition they represent, some folks expect payments companies like Visa and PayPal to jump into stablecoins. I would point out that another option available to them is to advocate for regulation to neutralize that competition.

- Actual regulation isn’t necessary to effectively ban unhosted wallets. Banks just need to feel like they are “risky” and they could tell stablecoin issuers, hey we’re not comfortable holding your reserves unless you stop allowing unhosted wallets. Why don’t you do like Libra?

- If that happens it’s bad for DeFi and decentralized stablecoin-backed stablecoins because the smart contracts count as unhosted wallets.

Nic Carter has made the point that the U.S. should be willing to give up some of the power that comes from control of dollar clearing in order to dollarize the world (and the internet I might add). I completely agree with his analysis here. Tolerating or even encouraging private stablecoin development would allow for the greatest degree of experimentation and innovation. It’s the right approach. I’m afraid, though, that if policymakers can be persuaded to pursue a strategy of digital dollarization, they will be very tempted to want the government to do it itself, which brings me to central bank digital currencies (CBDC).

Once and for all, central banks are not constrained by AML regulations in designing CBDCs

On Wednesday, Federal Reserve Bank of Cleveland President Loretta Mester gave a speech about payments that touched on CBDC. Media coverage of the speech focused on the “revelation” that the Fed has been looking at CBDCs for longer and more deeply than was previously known (though I don’t think is substantiated by what she said). Here’s the bit that caught my eye, though:

The experience with pandemic emergency payments has brought forward an idea that was already gaining increased attention at central banks around the world, that is, central bank digital currency (CBDC). Legislation has proposed that each American have an account at the Fed in which digital dollars could be deposited, as liabilities of the Federal Reserve Banks, which could be used for emergency payments. Other proposals would create a new payments instrument, digital cash, which would be just like the physical currency issued by central banks today, but in a digital form and, potentially, without the anonymity of physical currency. (Emphasis added.)

It’s the latest statement from a central bank that says or implies that a CBDC could not be anonymous like cash and it drives me nuts. She’s right that most legislative proposals would create accounts at the Fed for individuals (which by nature can be surveilled and censored), but the one legislative proposal to create a tokenized digital dollar specifically called for anonymous transactions. Yet I keep seeing central banks pretend anonymity is not an option.

Central banks and related authorities are increasingly publishing papers explaining what the design of a CBDC might look like. In itemizing the various design choices available, they explain that any design will be constrained by the necessity to ‘comply with AML law.’ However, no such constraint exists in reality and the various central bank papers that bring this up do no cite any specific law or regulation. It seems to be a tic on the part of the paper authors who seem to be assuming there must be such a law and are thus artificially limiting their design choices.

From the recent (excellent) Bank of England paper :

A CBDC payment system would need to be compliant with AML and CFT regulations and requirements. This means the identity of CBDC users would need to be known to at least some authority or institution in the wider CBDC network who can validate the legitimacy of their transaction.

Here is the Bank of Canada :

A CBDC system is required to comply with regulations (e.g., KYC and AML). This can dictate the level of privacy and the selection of privacy techniques. KYC may require entities to store personal data with proper classification. Generally, achieving high levels of privacy while complying with regulations is complicated. A designer, however, could build a system with hybrid privacy levels. In this, unregulated holdings and transactions (offering maximum privacy to users) would be permitted within limits (e.g., a maximum amount) alongside regulated ones without limits.

And here is the Federal Reserve:

Consumers often want the option to conduct anonymous private transactions when practical. Cash allows consumers to transact anonymously in the physical world. Most electronic payment systems, including RTGS, do not allow for anonymity because providers of these payment services must comply with rules and regulations, including AML, BSA, KYC, and electronic recordkeeping requirements. A CBDC would almost certainly need to comply with AML, BSA, and KYC regulations as well, making it unlikely that a CBDC would provide anonymity to the same degree as cash. Furthermore, as a digital payment system, a CBDC would maintain an electronic history of transactions. While technologies may exist to provide anonymity for CBDC, it is extremely unlikely that any central bank would embrace a fully anonymous instrument, given the potential for money laundering and other illicit financial activity.

Again, it makes no sense to say that a CBDC (which after all does not yet exist) must be designed to comply with AML obligations for the simple reason that no such obligations have yet been promulgated for CBDC. Laws governing CBDC have not yet been passed by legislatures because CBDC does not yet exist. While the Bank of England and Bank of Canada simply assert (without any citation) that a CBDC will certainly be subject to AML regulation, the Fed acknowledges it is making an assumption about what it thinks will likely be the law in the future, not what is law today. In both cases central banks are substituting their judgment for the legislature’s, which has not yet decreed on the matter, and are limiting their design options as a result, which is unwarranted. Until Congress says otherwise, anonymous CBDC should be on the table.

What’s funny about that the Fed’s assumption that “it is extremely unlikely that any central bank would embrace a fully anonymous instrument” is that today there are $1.95 trillion worth of fully anonymous Federal Reserve notes in circulation. Fed officials routinely tout their commitment to meet the demand for cash, and it has shown no interest in eliminating cash, so it’s not like their involvement in supplying “fully anonymous payment instruments” is reluctant.

There is no reason why Congress could not choose to opt for digital dollars that are as anonymous as physical notes, and indeed there are good reasons why doing so is in the national interest, not to mention consistent with American values such as liberty, privacy, and autonomy. The Fed should not presume to know what Congress and the people will want and should consider all options including anonymous, bearer digital currency.

Cyprus takes EU hostage over Turkey, exposes its foreign policy bankruptcy

The big money and power story of the week as far as I’m concerned is actually a non-story: it’s the EU’s complete inability to impose sanctions on Belarusian officials over the rigged election, exposing how bankrupt the idea of a common European foreign policy is.

As I mentioned last time, Cyprus refused to agree to the sanctions unless the EU also sanctioned Turkey over energy exploration in contested waters between Cyprus and Greece. Because imposing sanctions requires the unanimous consent of all 27 member states, the bloc is essentially being held hostage by tiny Cyprus. And it’s a big blow to the EU’s credibility because both at the national and EU level officials have been talking a big game about how the regime in Belarus would be punished.

And speaking of hostages, why won’t the EU take the Turkish issue seriously? France certainly seems like it wants to.

E.U. Failure to Impose Sanctions on Belarus Lays Bare Its Weakness - NYT

France and Greece back Cyprus, but not to the extent of blocking the Belarus decision. Yet France’s visible support for Greece and Cyprus against Turkey, including the sending of fighter planes and high-level diplomatic visits, all in the name of “European Union solidarity,” is nonetheless considered a factor in Cypriot intransigence.

Germany, which currently holds the bloc presidency, is pushing for the sanctions on Belarus, but at the same time is also trying to mediate the dispute between Turkey and E.U. members Cyprus and Greece. To that end, the Germans see further sanctions against Turkish officials as counterproductive and want to separate the issues.

I wonder if Germany’s reticence has anything to do with the millions of Syrian and other refugees that Turkey has previously threatened to let go into Europe if its wishes aren’t met?

The French certainly seem to have Turkey’s number. Speaking in Athens the week before last former French president Francois Hollande laid out the case against Turkey:

Turkey is the biggest threat to Europe today, and the Greeks need our help - The Independent

Hollande’s charge sheet includes multiple accusations: Erdogan is seeking to militarise the eastern Mediterranean; he has breached Nato obligations by buying Russian missiles; he has imprisoned hundreds of journalists and political opponents; he is obsessed with Islamism, promoting Islam in Europe and has converted two of the finest Byzantine Christian cathedrals in Istanbul into mosques; he flagrantly interferes in the politics of European countries including France and Germany, holding giant political rallies and insisting that Turkish EU citizens owe loyalty only to Turkey; his adventurism in Syria and his war on the Kurds are dangerous; his alliance with Libya was an act of aggression.

Meanwhile, guess who got it together to imposed sanctions on Belarus since it controls its own foreign policy?

UK makes first move in sanctions against Belarus - The Independent

The United Kingdom has announced it will move alone in imposing sanctions against Belarusian officials — thus bypassing an EU deadlock caused by Cyprus’s refusal to sign off on new restrictions.

In a parliamentary statement on Thursday, British Foreign Minister Dominic Raab said he would now work with Canada and the United States to “urgently” prepare a sanctions regime against the country’s unrecognised ruler Alexander Lukashenko and his enablers.

Dollar Death Watch

Wrong take, by Stephen Roach:

Why the US dollar is only going to fall faster and harder - SCMP

I continue to expect this broad dollar index to plunge by as much as 35 per cent by the end of 2021. This reflects three considerations: the rapid deterioration in macroeconomic imbalances in the United States, the ascendancy of the euro and renminbi as alternatives, and the end of the aura of American exceptionalism that has given the dollar Teflon-like resilience for most of the post-World War II era.

He’s got a point about the “unprecedented erosion of domestic savings and the current-account deficit,” but the idea that the euro and yuan are viable alternatives don’t pass the smell test.

Correct take:

US dollar remains world’s currency of choice despite slide - FT

“There have been quite a lot of dollar corrections over the last 20 years or so, and it seems like almost every time this happens we get the same stories [asking] if this could be the beginning of the end of the dollar,” said Mr Slater. “But the facts refuse to change on the ground.”

The events of March underscore this point. During this period of extreme volatility, all anyone wanted to hold was the buck. “When you get financial stress globally and risk aversion globally, people move into dollar assets,” said Mr Slater.

As coronavirus cases surge again and the threat of renewed lockdowns looms large, there is ample reason for investors to continue seeking out safety.

Moreover, on many metrics, the dollar faces few rivals. Whether in terms of its use in cross-border payments or its share of foreign exchange reserves held by global central banks, the dollar’s dominance is sweeping. Meanwhile, IMF data show the euro’s share of reserves flatlining around 20 per cent.

Further dollar weakness could reinforce this dynamic. According to Brad Setser, senior fellow at the Council on Foreign Relations, a US think-tank, export-heavy Asian economies tend to intervene in markets under these circumstances to prevent their currencies from appreciating. What results is more reserve accumulation by these central banks, not less.

“A weaker dollar thus typically results in higher not lower demand for dollars from the world’s reserve managers,” he said.

Various & Sundry

Trump tightens Cuba sanctions as he woos Cuban-American vote - AP

Americans won’t be allowed to bring home cigars and rum from Cuba under measures President Donald Trump announced Wednesday to financially starve the island’s government, a move taken as he tries to boost his appeal among Cuban-Americans, a crucial voting bloc in the battleground state of Florida.

Zoom cancels talk by Palestinian hijacker Leila Khaled at San Francisco State University - The Verge

Zoom has canceled a webinar due to be held at San Francisco State University (SFSU) this Wednesday featuring Leila Khaled, a member of the Popular Front for the Liberation of Palestine (PFLP) who took part in two plane hijackings in 1969 and 1970. YouTube and Facebook also intervened to stop the talk, according to reports.

The webinar was cancelled after pressure from Israeli and Jewish lobby groups including the Lawfare Project. They noted that the US government has designated the PFLP a terrorist organization, and claimed that by hosting Khaled on its service, Zoom was exposing itself to criminal liability for providing “material support or resources” to a terrorist group.

SFSU’s president, Lynn Mahoney, said in an open letter that the university disagreed with Zoom’s decision but recognized its right as a private company to enforce its policies. “We worked hard to prevent this outcome and have been actively engaging with Zoom,” wrote Mahoney. “Based on the information we have been able to gather to date, the University does not believe that the class panel discussion violates Zoom’s terms of service or the law.”

Risk is risk, man.

J. reports that the talk began live-streaming on YouTube on Wednesday night but was taken down approximately 23 minutes in after Khaled began discussing the right of occupied peoples to fight their occupiers “by any means possible, including weapons.” A link to the removed talk says it was taken down for violating YouTube’s terms of service.