Merkel’s Nord Stream dilemma, China-U.S. tech war, Bitcoin vs. stablecoins, EU stuck on Turkey and Belarus sanctions

Thanks to all of you who subscribed and got in on the ground floor of this operation. I hope you enjoy reading these missives as much as I’m enjoying writing them. Please do tell me what you think. What you like, what you don’t, what you disagree with.

Here’s what’s on the docket this week:

- Merkel’s Nord Stream dilemma, and what the heck is Nord Stream anyway?

- China-U.S. tech war reveals a lot about sanctions power

- Bitcoin vs. stablecoins for global trade settlement

- Belarus, Turkey, Greece, and Cyprus: The EU’s hands are full

- Plus various and sundry

Let’s get to it.

Merkel’s Nord Stream dilemma

The pressure is growing on Angela Merkel to scrap the Nord Stream 2 pipeline project in retaliation for Moscow’s poisoning of opposition leader Alexei Navalny. Leading politicians from all the mainstream parties are demanding that construction on the natural gas pipeline be suspended, but Merkel is resisting that nuclear option.

Germany Debates Halting Contentious Russian Pipeline Project - Der Spiegel

Within the government, however, that step remains off limits. Officially, at least. In the background, cabinet members admit that the option must at least be discussed. Construction on the project has been suspended anyway because the United States has threatened sanctions. It wouldn’t be that difficult, in other words, for the government to announce a moratorium itself and take ownership of the construction suspension,

The chancellor, though, would much prefer a European solution. The Navalny case, she is convinced, isn’t just an issue for Germany.

She would much rather have an EU response rather than a German one.

Merkel dampens talk of halting Nord Stream 2: party sources - Reuters

At a meeting of her conservative parliamentary group, Merkel reiterated her call for an EU response to the attack on Navalny but took a cautious line on the pipeline, said participants.

She told lawmakers she could hear that some people were talking about Nord Stream 2 in the context of an EU response but also said that opinion was divided. At the EU level many would not explicitly make a connection between the Navalny case and stopping the pipeline, she said, according to participants.

Bloomberg columnist Andreas Kluth, however, makes the case that she could do an about face:

After Navalny Poisoning, Angela Merkel Should Kill Nord Stream 2 - Bloomberg

Those who’ve watched her during her 15 years in office are reminded of another notable U-turn. In line with her party’s policy at the time, she initially extended the life of Germany’s nuclear power stations. But she knew that the German population was overwhelmingly against atomic energy. Then, in 2011, a tsunami caused three nuclear meltdowns in Fukushima. Merkel grasped that this was her opportunity to change direction. Instead of prolonging nuclear power, Germany started exiting it altogether.

She may view the crime against Navalny in the same way as Fukushima. The geopolitical case against Nord Stream 2 is stronger than ever, just as the economic case for it becomes ever weaker . In the coming days or weeks, Merkel therefore could — and should — seize this moment and end it.

This is a funny analogy because shutting down the nuclear power plants is in large part responsible for Germany’s dependence on Russian gas. But he’s got a point. Google the words Merkel and u-turn and you’ll see she has a penchant for holding out for a long time on an issue before suddenly adopting a diametrically opposed but politically expedient position.

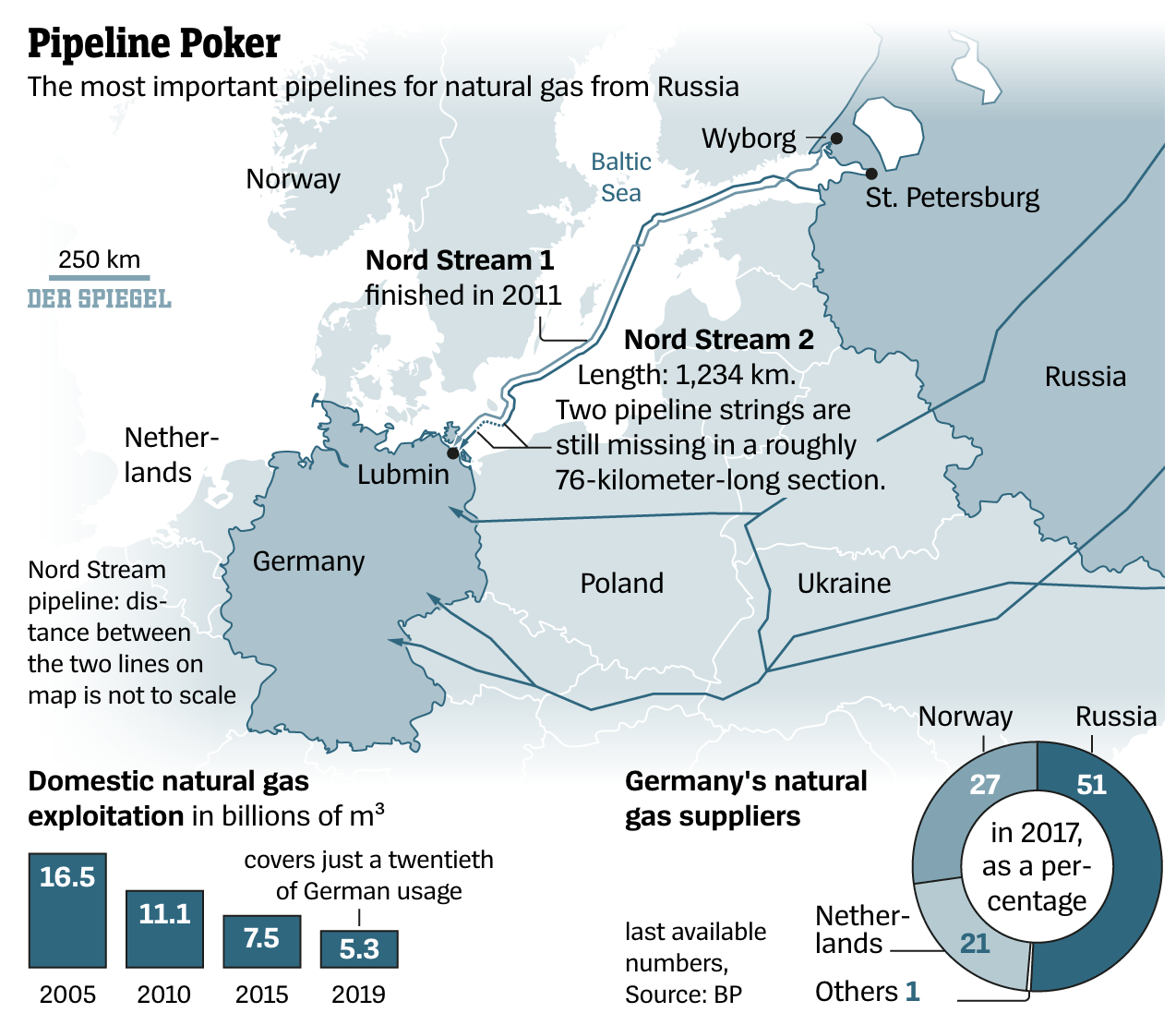

At this point, you might be asking yourself, what the heck is Nord Stream 2, anyway? I’ll tell you. It’s an offshore natural gas pipeline being built from Russia to Germany that runs parallel to an existing pipeline called Nord Stream 1. Construction started in 2015 and it is 95% complete. When it is finished it will double the capacity of the original pipeline.

Today Russia supplies over half of Germany’s natural gas and over 40% of the EU’s. With the completion of Nord Stream Germany’s and Europe’s dependence on Russia for its energy needs will only grow, and so will Russia’s influence. To spell it out, Russia would be able to threaten to turn off the lights in Germany and Europe.

Since the U.S. guarantees Europe’s security, it has long opposed the project and has tried to pressure Germany not to build it. Not only would it increase Russian influence over Germany, but it would also allow Russia to bypass existing pipelines to Germany that go through Ukraine, Poland, and other Central European states weakening them as well. Conveniently, the U.S. has a solution for Germany and the EU’s growing energy needs: U.S.-produced liquified natural gas from shale that can be shipped across the Atlantic.

The German government, it seems, has convinced itself that it can compartmentalize its energy business with Moscow and keep it separate from its politics. After all, even after tensions rose between Germany and Russia over the latter’s invasion of Ukraine, Moscow’s gas deliveries remained dependable. Beneath this delusion is the fact that Nord Stream 2 is great business for everyone involved. It will provide cheaper energy for households and businesses and create plenty of jobs. (It helps that the chairman of the Russian-state-owned Nord Stream 2 company is Merkel’s predecessor as chancellor, Gerhard Schroeder.) And it should go without saying that Germany needs the gas: domestic energy production is and will remain in decline as nuclear and coal are phased out and domestic gas is depleted.

Nord Stream 2 clearly seems to be a mistake, but you’d think it is Germany’s mistake to make. That’s not how the U.S. sees it. Secretary of State Mike Pompeo has said the U.S. will work “to stop the Nord Stream 2 project that … risks further compromising the sovereignty of European nations that depend on Russian gas.” So, in order to protect Germany’s sovereignty, the U.S. has imposed sanctions on Nord Stream 2 threatening any firm (German or otherwise) that helps complete the pipeline. As a result, the project seems to be on pause, though the Russians are trying to finish it themselves.

The U.S. could further step up the pressure. Concerned for Germany’s sovereignty, three U.S. senators from LNG-producing states last month sent a letter to a German port (in Merkel’s own constituency no less) threatening “crushing legal and economic sanctions” if it continued facilitating work on the project. The U.S. could also impose further sanctions on Russia for the Navalny poisoning:

Bipartisan lawmakers call on Trump to launch investigation into Alexei Navalny poisoning - Axios

Chairman Eliot Engel (D-N.Y.) and ranking member Michael McCaul (R-Texas) note that U.S. law requires the administration to determine within 60 days whether an accused country has used chemical weapons in violation of international law. If this is the case, U.S. sanctions must be imposed.

The big picture: The Trump administration previously slapped sanctions on Russia under the same Chemical and Biological Weapons Control and Warfare Elimination Act of 1991 after determining that the Kremlin used a nerve agent to target former Russian intelligence officer Sergei Skripal on British soil.

China-U.S. tech war reveals a lot about sanctions power

Another week, another exchange of threats between the U.S. and China. What’s interesting is the effects the threats had and what they show about the two countries’ relative power.

Reuters reported on Friday that the Trump administration is considering blacklisting SMIC, China’s top semiconductor manufacturer. The result?

US sanction threat wipes 23% off the value of China’s biggest chipmaker - CNN

The Department of Defense declined to comment on the reports. SMIC, China's biggest semiconductor maker, said on Monday that it was "in complete shock."

Semiconductors are key to China’s goals of technological leadership, yet despite billions in subsidies and no compunction about stealing intellectual property, it is still years behind the cutting edge and remains tied to U.S. knowhow. Here is a good interview with Paul Triolo of Eurasia Group and New America:

For example, the leading Chinese domestic foundry, [Semiconductor Manufacturing International Corporation], is just not at the same level. They're two or three generations behind leaders like [Taiwan Semiconductor Manufacturing Company], Samsung and Intel. And the U.S. has acted to cut off their ability to acquire advanced lithography equipment, for example, so [SMIC can't] can move to more advanced nodes in semiconductor manufacturing. Huawei has nowhere to turn here. There's no domestic champion that's going to come to Huawei's rescue on the semiconductor side. So that's existential.

The problem is these are tough technologies to master. It's not really a function so much of funding as it is of talent and technology know-how. That's going to take time. Certainly China has come a long way in the last five years, in terms of design and manufacturing of semiconductors. But this is a global industry that's taken 20 or 30 years to develop some of the division of labor. And it's just really hard for China and Chinese companies to recreate these global value chains that took so long to develop, and cutting-edge things in the software services side or in the semiconductor manufacturing side. So China [is facing] a real uphill battle.

The main focus of the interview with Triolo was actually the trade sanctions placed last month on Huawei restricting the chips it can acquire. This week Samsung announced it is joining TSMC in suspending all transactions with the Chinese firm.

Huawei has stockpiled chips ahead of the sanctions kicking in, but it will run through those within a year and then its viability as a going concern is in real doubt. Meanwhile, it’s not just China taking a hit:

Samsung, SK Hynix to suspend trade with Huawei - UPI.com

South Korean firms are bracing for significant drop in sales. SK Hynix reported a total of $13.3 billion in revenue for the first half of 2020, according to the JoongAng. Of that amount, $5.5 billion, or more than 40%, was earned through exports to China, with many Chinese firms purchasing the South Korean chips in order to supply Huawei’s production lines for smartphones and computer tablets.

So that was the U.S. threat. Big immediate effect. What about China’s threat?

China to sanction senior US officials who visit Taiwan: Global Times editor - Reuters

China will impose sanctions on senior U.S. officials who visit Taiwan, and American companies that they have ties with, the editor in chief of the Global Times [Party] newspaper said on Tuesday.

Hu Xijin said on his official Twitter account that those being sanctioned would never be allowed to enter mainland China, and that any U.S. companies they have ties with would lose access to the Chinese mainland market.

This was largely met with a shrug. The officials who would be targeted don’t really care, and market access restrictions seem like a nuclear option China won’t really use. Bloomberg has a good piece on the dynamic:

Dollar Dominance Gives U.S. Upper Hand in China Sanctions Fight - Bloomberg

Meanwhile, the “firm countermeasures” that Beijing has threatened against U.S. officials including Senators Marco Rubio of Florida and Ted Cruz of Texas have yet to be felt across the Pacific. None of the dozen American individuals sanctioned since July have received notice of what the penalties would entail, other than the assumption that they wouldn’t be welcomed in China.

“I wear it as a badge of honor, but Beijing’s actions don’t have any impact on me,” said Rubio, a frequent China critic who has been named in sanctions announcements twice this summer.

“China doesn’t have too many tools to implement the sanctions because the U.S. payment system is so prolific and pervasive,” said Edwin Lai, a Hong Kong University of Science and Technology economics professor who specializes in renminbi internationalization. “China is disadvantaged in the sanctions game because its payment system is underdeveloped and yuan internationalization is decades away.”

The U.S.’s financial sanctions also carry fewer risks of backfiring than China’s usual tactic of cutting off market access. The Chinese economy is still reliant on foreign investment and Beijing is wary of moves that could scare off multinationals and scuttle its phase-one trade deal with Trump. Chinese diplomats have in recent weeks expressed a desire to de-escalate tensions ahead of the U.S. presidential election on Nov. 3.

While the U.S. has a wide array of economic weapons at hand, the options China has are nuclear and seem like last resorts:

China has other tools to deploy, if ties deteriorate badly enough to justify broader economic damage, including unloading Treasuries or blocking exports of rare earths and other key manufacturing components. Beijing could also roll back cooperation on sanctions against North Korea and Iran.

And that’s not about to change. As I highlighted in my last update, China seems to be a little desperate at the moment to internationalize the Yuan, not just to have sanctions leverage of its own, but to be able to avoid U.S. sanctions. Yet it’s got a steep hill to climb on that, too:

For China to gain global financial leverage, it needs to open its capital account to encourage greater use of the yuan, said Scott Kennedy, a senior adviser and trustee chair in Chinese business and economics at the Center for Strategic and International Studies. The cost would be giving investors some ability to influence China’s exchange rates.

“Until Beijing changes the underlying calculus, China will not be able to incorporate financial restrictions into its coercive diplomacy toolkit,” Kennedy said.

China hopes its new central bank digital currency will help, but as I’ve been saying for over a year, a digital yuan is still a yuan with all the same pathologies. Digitization certainly would make a reliable currency more attractive for international use, but as long as the yuan is tightly managed by China rather than free floating, it’s not going to inspire confidence. Quartz has a good explanation why widespread international use of a digital yuan would actually complicate things for China:

The same problems plaguing the yuan will plague China’s digital currency - Quartz

Suppose Iran sold China a large amount of oil, and accepted the digital yuan as payment. That would help with Beijing’s goal of pursuing more widespread use of the yuan in international transactions. But Tehran would probably want to use at least a quarter of those earnings to buy goods from Europe, said Shih, so they would need to convert a portion of the digital yuan into dollars and euros, the second-most used currency for global payments.

“If that happened on a very large scale, you’d have hundreds of billions of renminbi accumulating in Hong Kong,” a major clearing center for yuan-denominated transactions. And if those yuan were converted to another currency in large amounts, “the renminbi will be under downward pressure and the PBOC will have to step in” to prop up its value.

Also worth noting this week:

Non-Chinese executives working for and with Chinese companies, think tanks and academia say that their jobs are increasingly stressful, unpredictable and raise concern about how “working for the enemy” will look on their résumés as ties crumble.

Bitcoin vs. stablecoins for global trade settlement

Speaking of digital yuan in international trade, last week I tweeted out the following article and quote and said it made sense as long as there is no digital dollar alternative, whether state- or privately-issued.

Digital currency and the new cold war - OMFIF

Imagine if, say, 2bn people along the Belt and Road trading corridors start using Alipay and WeChat wallets. They may begin by using their own currencies, but could shift to the digital renminbi if it offers speed, convenience and person-to-person transfers. A trader in Africa may soon find it more convenient to order goods from a Chinese partner via WeChat and settle via Alipay. And if they can settle instantly with their Chinese digital currency (or, to be fair, Libra or similar) then they will find themselves accepting the same in payment.

Folks quickly pointed me to this very interesting story that got a lot of attention in the cryptocurrency community:

How bitcoin met the real world in Africa - Reuters

Odunjo sources handsets and accessories from China and the United Arab Emirates. His Chinese suppliers asked to be paid in the cryptocurrency, he said, for speed and convenience.

The shift has boosted his profits, as he no longer has to buy dollars using the Nigerian naira or shell out fees to money-transfer firms. It is also one example of how, in Africa, bitcoin - the original and biggest cryptocurrency - is finding the practical use that it has largely failed to elsewhere.

Monthly cryptocurrency transfers to and from Africa of under $10,000 - typically made by individuals and small businesses - jumped more than 55% in a year to reach $316 million in June, the data from U.S. blockchain research firm Chainalysis shows.

The number of monthly transfers also rose by almost half, surpassing 600,700, according to Chainalysis, which says the research is the most comprehensive effort yet to map out global crypto use. Much of the activity took place in Nigeria, the continent’s biggest economy, along with South Africa and Kenya.

This represents a reversal for bitcoin which, despite its birth as a payments tool over a decade ago, has mainly been used for speculation by financial traders rather than for commerce.

That’s a great story. It shows that there is real demand for permissionless payments, and it makes sense that Bitcoin, with its long track record and deep liquidity, would be filling that role. Still, I wondered, wouldn’t these traders rather use a permissionless dollar if they could? Is there any data on stablecoin use in the region and how it compares to Bitcoin?

It would be difficult to figure this out, I was told, because trades in these countries are done not on exchanges, but P2P via Paxful or LocalBitcoins. These only list Bitcoin, so you’d only have half the data. And then, the following day, as if on queue:

P2P crypto exchange Paxful expands beyond bitcoin, adds Tether to its platform - The Block

At least until last December, Paxful wanted to remain a “bitcoin-only platform.” When asked what led to the move, Paxful CEO Ray Youssef told The Block in an interview that “whatever the ideological stance we have, that’s great. But everything comes down to our customers and what they want.”

“And the truth is that stablecoins do a much better job of serving the real use cases of finance, especially in emerging markets. They don’t suffer from volatility,” said Youssef.

He went on to say that Paxful customers from inflation-hit countries like Venezuela, Argentina, and Nigeria, want to have access to U.S. dollars via Tether. “The U.S. dollar is still the reserve currency of the world. That’s not going to change for a while. So that’s something we accept and move with.”

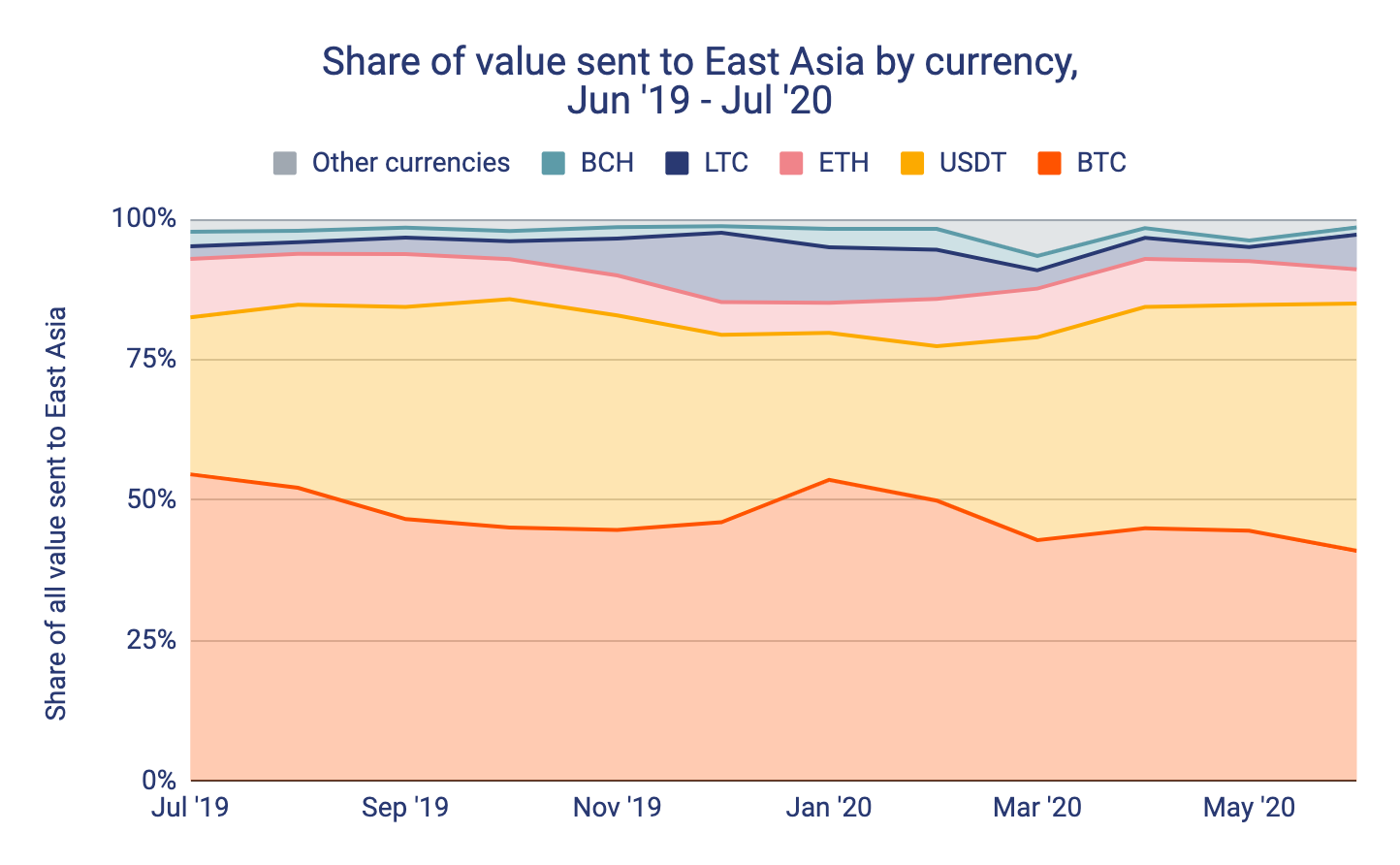

Bitcoin is great when there is no other good alternative. It’s an escape hatch for liberty, which is invaluable. If you’re only other option is the naira or the bolivar, you’ll take Bitcoin any day. But add a permissionless, tokenized dollar option, and I think people will prefer that, especially if they’re engaged in global commerce. Certainly it seems like folks in China might prefer a stablecoin. According to a new Chainalysis report, Tether was “beating out Bitcoin to be the most-received cryptocurrency by East Asia-based addresses in June 2020.”

I think I may be writing a fuller treatment of stablecoins soon, but for now I’ll just say I agree with Nic Carter’s thesis that if the U.S. is smart it would lean in to the backdoor dollarization that stablecoins make possible.

Belarus, Turkey, Greece, and Cyprus: The EU’s hands are full

EU to consider sanctions on Turkey over Mediterranean gas drilling - DW

Long story short, Turkey has been doing gas exploration in the Eastern Mediterranean in the waters between EU members Greece and Cyprus. That led Athens to stage naval exercises to defend maritime territory it claims. Things have been escalating between the old foes. Greece and Cyprus called for the bloc to sanction Turkey. Ted Galen Carpenter has a piece explaining the worst case scenario, which is what makes this worth paying attention to:

An Old NATO Nightmare Returns: Possible War between Greece and Turkey - Cato Institute

There is one important difference, though, between the [1974] Cyprus crisis and a possible new confrontation between Athens and Ankara. Key NATO powers, most notably France and Italy, are not happy about Erdogan’s increasingly undemocratic rule and his government’s maverick, often pro‐Russian, behavior on security issues. In addition, France has openly challenged Turkey’s territorial and resource claims in the eastern Mediterranean, and in late August, French warships and planes joined a joint military exercise with Greece and Cyprus to convey a blunt message of displeasure to Ankara. Washington may find it far more difficult today to drag its NATO allies into taking a pro-Turkish stance in case of an armed confrontation between Greece and Turkey than it did in 1974.

U.S. and other Western leaders have long worried about what to do if an armed conflict ever erupted between two NATO members. Rapidly rising tensions between Greece and Turkey, primarily involving a maritime dispute over oil, natural gas, and other resources under the eastern Mediterranean, have brought that nightmare to the surface once again. Germany’s Foreign Minister, Heiko Maas, warned both governments in late August against further military escalation. “Fire is being played with and any small spark could lead to catastrophe,” he stressed.

The EU is also considering sanctions against Belarus after its rigged election last month and its harrowing persecution of opposition leaders in recent days. The U.S. is also considering new sanctions. This is interesting tho:

Turkey-Cyprus dispute holding up EU's Belarus sanctions, diplomats say - Reuters

European Union sanctions on Belarus are being delayed by a separate dispute between Cyprus and Turkey over energy resources in the Eastern Mediterranean, four EU diplomats said, in the latest sign of paralysis in the bloc’s foreign policy.

Because EU sanctions must have the unanimous approval of all members, the Cypriots are holding the Belarus sanctions hostage until they get Turkey sanctions…

A Cypriot diplomatic source told Reuters that Nicosia supported the sanctions but has requested time to study the planned EU travel bans and asset freezes because, as one of the EU’s smallest states, the island does not have the organisational capacity to review them quickly.

“We categorically deny blocking and linking the two procedures,” the diplomatic source said of the Belarus and Turkey issues.

Various & Sundry

And finally, some U.S. sanctions potpourri…

U.S. Seeks to Reshape Lebanese Government With New Sanctions - WSJ

U.S. Imposes Sanctions Over Russian Election Meddling - WSJ

Treasury and Delaware Sign Pact to Boost Sanctions Enforcement - WSJ